Mastering The Snowball Method: Tackling Debt One Step At A Time

In “Mastering The Snowball Method: Tackling Debt One Step At A Time,” you’ll find valuable insights on how to efficiently tackle your debt and take control of your financial situation. This article aims to help individuals struggling with debt by providing practical strategies and methods to effectively pay off their obligations. By implementing the snowball method, you can gradually eliminate your debts, gaining momentum as you go and ultimately achieving financial freedom. With clear and actionable steps, this article will guide you toward a debt-free future.

Understanding the Snowball Method

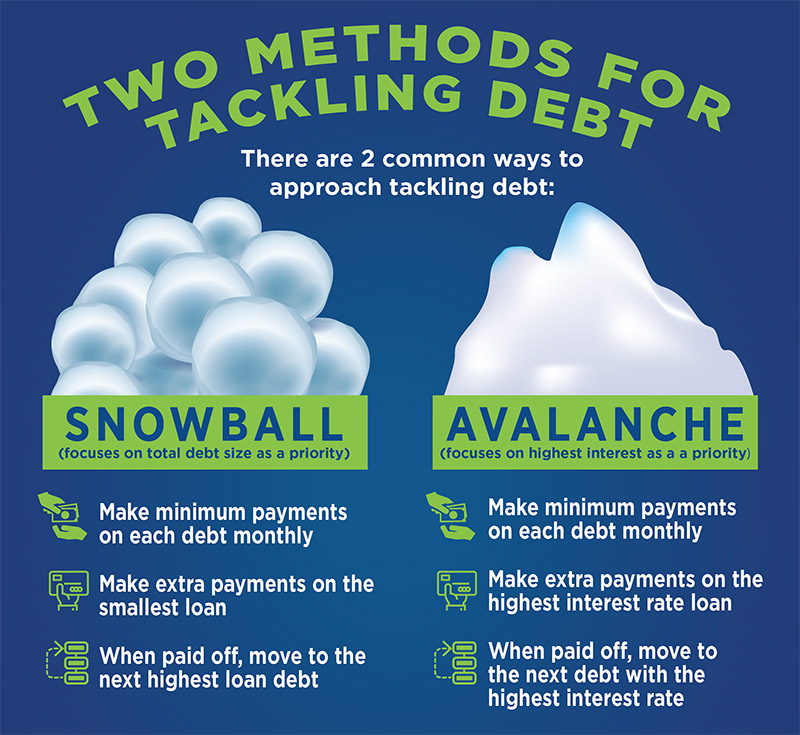

The snowball method is a debt repayment strategy that aims to help individuals tackle their debts in a systematic and organized way. It is a popular approach for individuals who have multiple debts and want to prioritize and pay them off effectively. By following the snowball method, you can gain control over your finances and work towards becoming debt-free.

What is the snowball method?

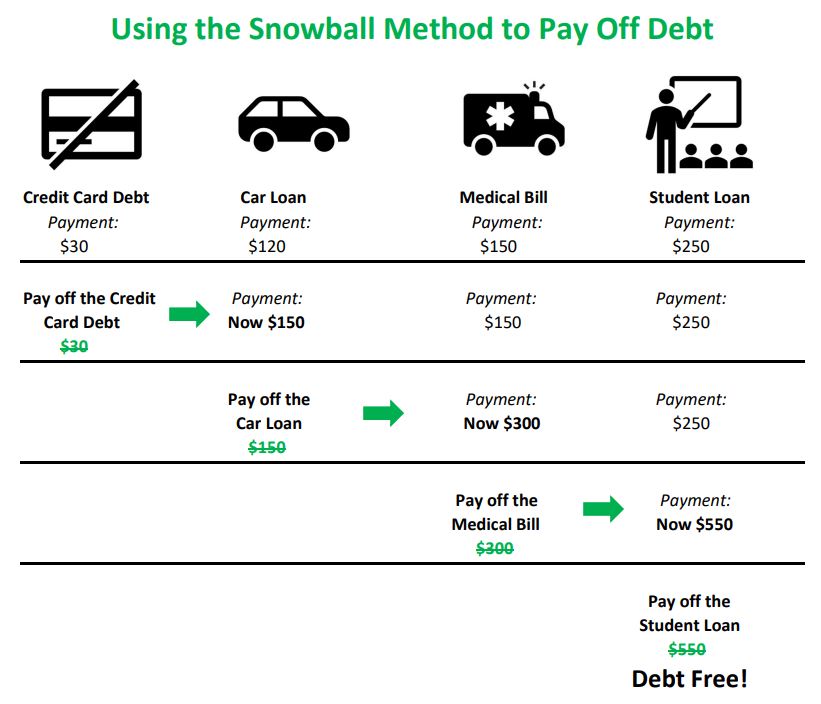

The snowball method involves listing all your debts and then prioritizing them based on their size. The key idea behind this method is to focus on paying off the smallest debt first while making minimum payments on the larger ones. Once the smallest debt is paid off, you can roll the amount you were paying toward that debt into the next smallest debt. This approach creates a snowball effect as you tackle each debt one by one, gaining momentum and motivation along the way.

How does the snowball method work?

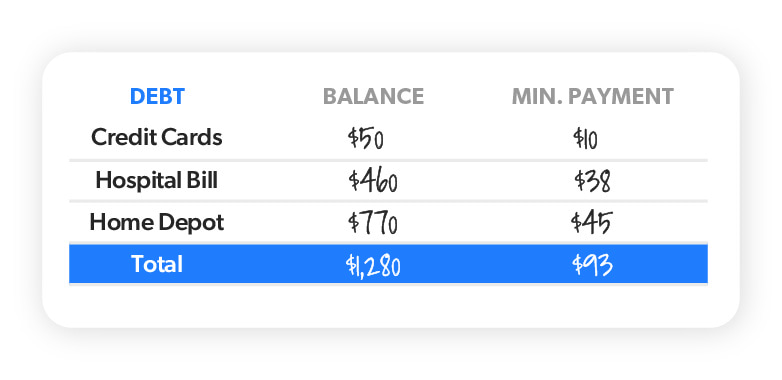

To start using the snowball method, gather all your debt information including credit cards, loans, and other outstanding balances. Once you have a clear picture of your debts, calculate the total amount you owe. This will give you an understanding of the magnitude of your debt and help you set realistic goals.

After assessing your total debt, you can prioritize your debts by listing them from smallest to largest. This step will help you determine which debts to focus on first. By prioritizing the smallest debts, you can quickly pay them off, gaining a sense of accomplishment and motivation to continue.

Benefits of the snowball method

The snowball method offers several benefits that can aid you in successfully paying off your debts. Firstly, by starting with the smallest debts, you can experience early wins, which boosts your confidence and motivates you to keep going. This psychological advantage allows you to maintain momentum throughout the repayment process.

Additionally, the snowball method encourages discipline and consistency. By making minimum payments on larger debts while putting extra funds towards the smallest debt, you are able to maintain a steady progress towards becoming debt-free. This method provides a clear plan of action and helps you stay focused on your goals.

Furthermore, the snowball method helps you build positive financial habits. As you become more mindful of your spending and allocate funds towards debt repayment, you develop a greater awareness of your financial situation. This method not only aids in debt reduction but also fosters a healthier relationship with money in the long term.

Assessing Your Debt

Before diving into the snowball method, it is essential to assess your debt situation thoroughly. By understanding the full extent of your debts, you can develop a more effective repayment strategy. Here are some steps to help you assess and evaluate your debt.

Gather all your debt information

To accurately assess your debt, gather all relevant information regarding your outstanding balances. This includes credit card statements, loan documents, and any other debts you may have. By having all the necessary information in one place, you can gain a clear understanding of the number and nature of your debts.

Calculate your total debt

Once you have collected all your debt information, calculate the total amount you owe. This step is crucial as it provides you with a comprehensive view of your current debt situation. Knowing the exact amount can help you set realistic goals and devise a repayment plan accordingly.

Prioritize your debts

After calculating your total debt, it is time to prioritize which debts to tackle first. By prioritizing, you can determine the order in which you will pay off your debts. The snowball method suggests starting with the smallest debt first, regardless of the interest rate. This prioritization method allows you to experience quick wins and gain momentum as you progress through your debt repayment journey.

By prioritizing your debts, you can allocate your resources more effectively and work towards paying off your debts in an organized manner. Remember, the goal is not just to pay off your debt but to do so strategically and efficiently.

Creating a Budget

Now that you have assessed your debts, it is time to create a budget that will help you manage your finances and allocate funds toward debt repayment. A budget serves as a roadmap for your financial journey, ensuring that you are aware of your income, expenses, and debt obligations.

Track your income and expenses

To create an effective budget, you must track your income and expenses. Start by calculating your monthly income from all sources, including your salary, freelance work, or any other income streams. Next, list all your expenses, both fixed and variable. Fixed expenses include rent, utilities, and loan payments, while variable expenses may include groceries, entertainment, and dining out.

By tracking your income and expenses, you gain a clear understanding of your financial inflows and outflows. This allows you to identify areas where you may be overspending and determine areas where you can cut back to allocate more funds toward debt repayment.

Identify areas to cut back

One of the key components of a successful debt repayment plan is identifying areas where you can cut back on expenses. Take a closer look at your variable expenses and identify areas where you can make adjustments. For example, you can reduce eating out and opt for cooking at home, or you can minimize recreational spending and find cheaper alternatives for entertainment.

Identifying areas to cut back requires a certain level of discipline and sacrifice. However, it is important to remember that these adjustments are temporary and will lead to long-term financial stability. By reallocating funds toward debt repayment, you are taking proactive steps toward becoming debt-free.

Allocate funds towards debt repayment

Once you have identified areas where you can cut back, it is time to allocate the funds you have saved toward debt repayment. In addition to making minimum payments, allocate any additional funds you can afford to the smallest debt. By doing so, you expedite its repayment and gain momentum for the next debt in line.

Creating a budget and allocating funds toward debt repayment requires discipline and consistency. It is important to stick to your budget and make regular payments towards your debts. By doing so, you are actively taking control of your financial situation and working towards a debt-free future.

Taking Advantage of Snowball Method

Now that you have assessed your debt and created a budget, it is time to delve into the snowball method and explore how you can effectively implement it in your debt repayment journey. By taking advantage of this method, you can accelerate your progress toward becoming debt-free.

Start with the smallest debt

As mentioned earlier, the snowball method recommends starting with the smallest debt first, regardless of the interest rate. By targeting the smallest debt, you can quickly pay it off and gain a sense of accomplishment. This early win boosts your motivation and provides the necessary momentum to tackle larger debts.

Starting with the smallest debt allows you to build confidence and belief in your ability to become debt-free. It shows you that progress is possible and encourages you to continue your debt repayment journey.

Pay more than the minimum payment

While making minimum payments is crucial to stay current, it is important to pay more than the minimum whenever possible. By increasing your monthly payment, you can expedite the repayment process and reduce the overall interest you will end up paying.

To free up additional funds for larger debt payments, consider cutting back on discretionary spending, reevaluating your monthly expenses, and finding ways to increase your income. Every extra dollar towards debt repayment counts and brings you closer to your goal.

Roll over payments to the next debt

Once you have paid off the smallest debt, do not stop there. Take the amount you were paying towards the smallest debt and roll it over to the next smallest debt. By doing this, you are accelerating the repayment process and maintaining the momentum generated from paying off the first debt.

Rolling over payments allows you to create a snowball effect as each debt gets paid off. The momentum and motivation gained from paying off each debt will push you closer to your ultimate goal of becoming debt-free.

Increasing Your Income

In addition to the snowball method, increasing your income can significantly impact your ability to repay your debts. By exploring additional sources of income, considering a side hustle, or negotiating a raise or promotion, you can create more financial flexibility and accelerate your journey toward becoming debt-free.

Explore additional sources of income

Consider exploring additional sources of income to supplement your regular earnings. This may include taking on part-time work, freelancing, or finding creative ways to monetize your passions or skills. By diversifying your income streams, you can increase your overall earning potential and allocate more funds toward debt repayment.

Consider a side hustle

A side hustle can be a great way to boost your income while maintaining your regular job. Whether it’s starting a small business, offering consulting services, or providing freelance work, a side hustle allows you to leverage your skills and generate additional income. The extra earnings from your side hustle can be specifically allocated towards debt repayment, helping you pay off your debts faster.

Negotiate a raise or promotion

If you are already employed, consider negotiating a raise or seeking a promotion. Present your case to your employer, highlighting your contributions and the value you bring to the organization. A higher salary or promotion can provide you with more financial resources to allocate toward debt repayment.

It is important to take the initiative and advocate for yourself. By negotiating a raise or promotion, you not only increase your income but also demonstrate your commitment to financial stability and debt reduction.

Reducing Your Expenses

In addition to increasing your income, reducing your expenses is another effective strategy to accelerate your debt repayment journey. By evaluating your discretionary spending, cutting back on non-essential items, and negotiating lower interest rates or fees, you can free up additional funds to put toward your debts.

Evaluate your discretionary spending

Take a close look at your discretionary spending and evaluate which expenses are necessary and which can be reduced or eliminated. This may include subscriptions, memberships, entertainment, and luxury items. By identifying areas where you can cut back, you can redirect those funds toward debt repayment.

Cut back on non-essential items

Cutting back on non-essential items can make a significant impact on your overall financial situation. Consider alternatives or cheaper options for everyday expenses such as groceries, clothing, and entertainment. By being mindful of your spending and making conscious choices, you can reduce your overall expenses and accelerate your debt repayment.

Negotiate lower interest rates or fees

Contact your creditors and explore the possibility of negotiating lower interest rates or fees. By doing so, you can reduce the overall cost of your debts and allocate more funds toward paying off the principal balance. Creditors may be open to negotiation, especially if you demonstrate a commitment to debt repayment and present a strong case.

Reducing your expenses requires discipline and a willingness to make temporary sacrifices for long-term financial freedom. By carefully evaluating your spending and negotiating better terms with your creditors, you can optimize your debt repayment strategy and expedite your journey toward becoming debt-free.

Staying Motivated

Paying off debts can be a long and challenging process, so it is important to stay motivated along the way. By setting specific debt reduction goals, celebrating milestones, and finding support from friends and family, you can maintain your focus and momentum.

Set specific debt reduction goals

Setting specific debt reduction goals is essential to staying motivated. By breaking down your total debt into smaller, manageable goals, you can track your progress and celebrate each milestone achieved. These goals may include paying off a certain amount by a specific date or eliminating a particular debt completely.

Visualize your goals and remind yourself regularly of what you want to achieve. This clarity and focus will keep you motivated and dedicated to your debt repayment journey.

Celebrate milestones along the way

As you achieve each goal, take the time to celebrate and acknowledge your progress. Celebrations do not have to be extravagant or expensive; they can be as simple as treating yourself to a small reward or enjoying a favorite activity. Recognizing your accomplishments and celebrating milestones serves as positive reinforcement and encourages you to keep pushing forward.

Find support from friends and family

Having a support system is crucial when going through the debt repayment journey. Reach out to friends and family for encouragement, advice, or even to share your successes and challenges. Surrounding yourself with individuals who understand your financial goals and provide support can significantly impact your motivation and overall success.

Consider joining online communities or forums where individuals with similar financial goals share their experiences and provide support. Engaging with like-minded individuals can boost your morale and provide valuable insights and strategies.

Dealing with Setbacks

Setbacks are a natural part of any journey, including the one towards becoming debt-free. It is important to be prepared for unexpected expenses, avoid accumulating more debt, and reassess and adjust your plan if needed.

Prepare for unexpected expenses

Even with careful planning, unexpected expenses can arise. It is important to have an emergency fund or savings set aside to cover these unexpected costs. By having a financial safety net, you can address these expenses without resorting to additional debt or derailing your debt repayment progress.

Avoid accumulating more debt

One of the key principles of the snowball method is to avoid accumulating more debt while you are working towards paying off your current debts. This requires discipline and mindful spending. Be conscious of your financial decisions and avoid using credit cards or taking on new loans unless absolutely necessary.

Keeping your focus on debt reduction and staying committed to your repayment plan will help you avoid unnecessary setbacks and maintain steady progress towards your goal.

Reassess and adjust your plan if needed

If you encounter significant financial changes or obstacles along the way, it may be necessary to reassess and adjust your debt repayment plan. Life circumstances can change, and flexibility is key to adapting to new situations. Evaluate your budget, goals, and strategies to ensure they align with your current financial needs and capabilities.

If necessary, seek professional help or guidance to assist you in reassessing your plan. Professionals such as credit counselors or financial advisors can provide valuable insights and strategies to help you navigate through setbacks and challenges.

Seeking Professional Help

Seeking professional help can be beneficial if you find yourself struggling to manage your debts or need expert advice and guidance. Professionals such as credit counselors, debt consolidation agencies, and financial advisors can assist you in developing a customized plan that suits your specific financial situation.

Considering credit counseling

Credit counseling agencies can provide guidance and support in managing your debts. They can help you create a budget, negotiate with creditors, and provide education on financial management. Credit counseling can be particularly useful if you feel overwhelmed by your debt or need help developing a structured plan.

When choosing a credit counseling agency, ensure that they are reputable, accredited, and have a track record of successfully helping individuals in debt. Research and compare different agencies to find the one that best fits your needs.

Exploring debt consolidation

Debt consolidation involves combining multiple debts into a single loan or payment plan. This can simplify your debt management by consolidating multiple payments into one and potentially offering a lower interest rate. Debt consolidation can be an effective strategy if you have high-interest debts or struggle to keep up with multiple payments.

Before considering debt consolidation, carefully evaluate the terms and conditions, as well as the fees associated with the process. Consult with a professional or financial advisor to determine if debt consolidation is the right approach for your specific situation.

Consulting a financial advisor

If you feel overwhelmed or uncertain about how to manage your debts, consulting a financial advisor can provide expert guidance and support. Financial advisors can help you create a comprehensive debt repayment plan, evaluate your financial goals, and develop strategies to achieve them. They can also assist with long-term financial planning and provide insights on investments, insurance, and retirement planning.

When seeking a financial advisor, ensure that they are reputable, qualified, and experienced in dealing with debt management and financial planning. Take the time to research and meet with potential advisors to find someone who understands your goals and can provide the guidance you need.

Maintaining Financial Health

Paying off your debts is a significant accomplishment, but it is equally important to maintain financial health once you have become debt-free. By building an emergency fund, establishing a savings plan, and avoiding falling back into debt, you can secure your financial future and continue on a path towards financial stability.

Build an emergency fund

An emergency fund is a crucial component of financial health. It acts as a safety net to cover unexpected expenses or income disruptions. Aim to build an emergency fund that can cover at least three to six months’ worth of living expenses. This will provide you with peace of mind and financial security.

Establish a savings plan

In addition to an emergency fund, establish a savings plan to achieve specific financial goals. Whether it’s saving for a down payment on a house, a dream vacation, or retirement, having a structured plan in place allows you to allocate and accumulate funds strategically. This will help you avoid relying on credit in the future and maintain long-term financial stability.

Avoid falling back into debt

Once you have become debt-free, it is important to stay vigilant and avoid falling back into debt. Continue to practice good financial habits, such as budgeting, tracking your expenses, and living within your means. By staying disciplined and mindful of your spending, you can prevent unnecessary debt and maintain the financial freedom you have achieved.

Taking advantage of the snowball method to pay off your debts is a journey that requires dedication, discipline, and perseverance. By following the steps outlined in this article, you can successfully navigate your debt repayment journey and work towards a brighter financial future. Remember, every step you take brings you one step closer to attaining financial freedom.

© 2015-2023 by burdenofdebt.com, a LIVenture. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of LiVentures LLC.