Avoiding Debt Traps – Common Pitfalls And How To Steer Clear

In this article, we explore the common pitfalls that can lead individuals into debt traps and provide practical strategies to avoid them. This article aims to offer guidance and support to those grappling with debt, offering insights into the risks involved and empowering readers to make informed financial decisions. By shedding light on the potential dangers and highlighting effective ways to navigate them, we hope to assist individuals in maintaining financial stability and achieving long-term freedom from debt.

Unhealthy Financial Habits

Overspending

Overspending is a common financial habit that can quickly lead to debt. It occurs when you consistently spend more money than you earn, relying on credit cards or loans to cover the gap. Whether it’s dining out excessively, treating yourself to expensive gadgets, or indulging in frequent shopping sprees, overspending can drain your bank account and put you in a precarious financial situation.

Impulsive Buying

Impulsive buying is another unhealthy financial habit that many people fall victim to. It involves making spontaneous and unplanned purchases without considering the long-term consequences. These impulsive decisions can lead to accumulating debt as you buy items you don’t truly need or can’t afford. It’s important to practice self-control and think critically before making any purchases to avoid falling into this trap.

Lack of Budgeting

One of the most fundamental financial habits to maintain a healthy financial life is budgeting. However, many individuals overlook this crucial step, which can have serious consequences. Without a budget, you may lose track of your expenses, overspend, and potentially miss payments on bills or loans. Creating a budget allows you to allocate your income towards necessary expenses, savings, and debt repayment, helping you stay on track and avoid unnecessary debt.

Relying on Credit Cards

High-Interest Rates

Credit cards can be useful tools when used responsibly, but relying on them too heavily can lead to financial trouble. One of the main pitfalls of credit cards is their high-interest rates. Failing to pay off the full balance each month can result in accumulating interest charges, making it harder to pay off your debt and potentially trapping you in a cycle of revolving debt.

Minimum Payments

Another common mistake people make with credit cards is only paying the minimum amount due each month. While it may be tempting to make the minimum payment, this approach prolongs the repayment period and increases the overall interest you’ll pay over time. It’s important to pay more than the minimum whenever possible to expedite the debt payoff process and minimize interest charges.

Accumulating Balances

Continuously carrying a balance on your credit cards can lead to a rapid accumulation of debt. It’s crucial to remember that credit cards are not an extension of your income but should be used as a convenient payment method to be paid off in full each month. Failing to pay off your credit card balances each month keeps you trapped in a cycle of debt and can hinder your financial progress.

Ignoring Warning Signs

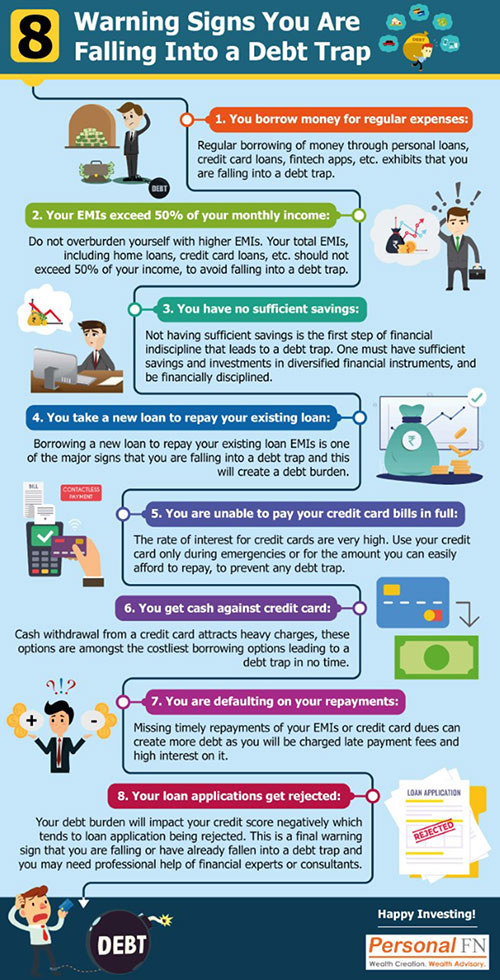

Constantly Borrowing Money

If you find yourself constantly needing to borrow money from friends, family, or financial institutions, it’s likely an indication that your financial habits are unhealthy. Constantly relying on borrowed funds can lead to a growing debt burden and strain relationships. It’s essential to address the root cause of this behavior by assessing your spending habits, creating a budget, and seeking ways to improve your financial situation.

Overdrawing Bank Accounts

Overdrawing your bank account occurs when you spend more money than is available in your account, resulting in negative balances and potential overdraft fees. This habit not only incurs unnecessary charges but can also damage your credit score if left unresolved. Regularly monitoring your account balances, tracking your expenses, and avoiding unnecessary transactions can help prevent overdrawing your bank account and keep your finances in good shape.

Late Payments

Consistently making late payments on your bills or loans can significantly impact your financial well-being. Late payments not only result in costly fees and penalties but can also negatively affect your credit score. By neglecting payment due dates, you risk tarnishing your credit history, making it challenging to secure future credit or loans at favorable terms. Developing a system for timely bill payments, such as setting up automatic payments or creating reminders, can help you overcome this unhealthy financial habit.

Predatory Lending

Payday Loans

Payday loans are small, short-term loans offered at high interest rates with the requirement of full repayment by your next paycheck. While they may appear as a quick fix for immediate financial needs, payday loans often trap borrowers in a cycle of debt due to their exorbitant interest rates and short repayment terms. Avoiding payday loans and exploring alternatives, such as personal loans from reputable lenders or seeking assistance from nonprofit organizations, can help prevent falling into this debt trap.

Title Loans

Similar to payday loans, title loans are short-term loans typically secured by using your vehicle title as collateral. While they may seem enticing in times of financial distress, title loans come with high-interest rates and the risk of losing your vehicle if you fail to repay the loan on time. Exploring other options, such as negotiating with creditors or seeking help from credit counseling organizations, is essential to avoid the potentially devastating consequences of title loans.

High-Interest Installment Loans

High-interest installment loans are loans that come with excessive interest rates and extended repayment terms. These loans can be tempting for individuals with poor credit scores or urgent financial needs, but they often lead to a never-ending cycle of debt. It’s crucial to carefully consider the terms and interest rates before taking out any installment loan and explore alternatives such as negotiating payment plans with existing creditors or seeking assistance from reputable financial institutions.

Lack of Financial Education

Understanding Interest Rates

A lack of understanding regarding interest rates can contribute to unhealthy financial habits and poor decision-making. Interest rates impact the overall cost of borrowing money, so it’s essential to comprehend how they can affect your finances. Educating yourself about different types of interest rates, the compounding effect, and how to calculate the total cost of a loan can help you make informed financial decisions and avoid unnecessary debt.

Reading Loan Contracts

Failing to read and fully comprehend loan contracts is a common mistake that can have serious consequences. It’s vital to thoroughly review any loan agreement before signing it to understand the terms, interest rates, repayment schedule, and any associated fees. By understanding the fine print, you can avoid unpleasant surprises, and predatory lending practices, and make informed decisions that align with your financial goals.

Building a Solid Credit Score

Having a good credit score is crucial for obtaining favorable loan terms, securing rental agreements, or even potential employment opportunities. However, a lack of financial education can lead to actions that negatively impact your credit score. Understanding the factors that influence credit scores, such as payment history, credit utilization, and length of credit history, is essential for building and maintaining a solid credit score. By practicing responsible credit usage and timely bill payments, you can avoid the pitfalls of poor credit and set yourself up for financial success.

Living Beyond Means

Peer Pressure and Social Media Influences

In today’s society, the pressure to keep up with the latest trends and maintain a certain lifestyle can be overwhelming. Peer pressure and social media influences often contribute to the unhealthy financial habit of living beyond your means. It’s crucial to prioritize your own financial well-being and not succumb to the need for constant validation through material possessions. Building self-confidence and focusing on personal goals can help you resist temptations and live within your means.

Unrealistic Lifestyle Expectations

Unrealistic lifestyle expectations can result in overspending and excessive debt. It’s important to differentiate between needs and wants, understanding that financial stability and long-term goals take precedence over short-term gratification. Setting realistic expectations and aligning your lifestyle choices with your financial capabilities can help you avoid the pitfalls of living beyond your means and create a more secure and fulfilling future.

Keeping Up with the Joneses

The desire to keep up with others and maintain a certain social status can put significant strain on your finances. Comparing yourself to others and feeling the need to match their lifestyles can lead to overspending and accumulating debt. It’s important to focus on your own financial goals and priorities, rather than succumbing to external pressures. Embracing a mindset of gratitude and appreciating what you have can help you break free from the unhealthy habit of trying to always keep up with the Joneses.

Failing to Prioritize Debt Repayment

Lack of Debt Management Plan

Failing to prioritize debt repayment is a common pitfall that individuals fall into. Without a clear debt management plan, it can be challenging to make progress toward becoming debt-free. Creating a plan that outlines your debt obligations, prioritizes high-interest debts, and establishes a realistic repayment timeline is crucial for taking control of your financial situation and achieving long-term financial freedom.

Minimum Payments Only

Paying only the minimum balance on your debts may provide temporary relief, but it prolongs the repayment process and increases the overall interest you’ll pay. By sticking to minimum payments, you may find yourself trapped in a never-ending cycle of debt. To overcome this unhealthy habit, consider allocating additional funds towards debt repayment each month, even if it means making sacrifices in other areas of your budget. This strategy will help you pay down your debts faster and save on interest payments.

Neglecting High-Interest Debts

Neglecting high-interest debts can have a detrimental impact on your overall financial health. By focusing solely on making minimum payments on all of your debts, you may miss the opportunity to pay off high-interest debts first, leading to increased interest charges over time. To avoid this trap, identify your highest-interest debts and prioritize them for repayment. By allocating more money towards these debts, you can reduce the interest burden and make substantial progress towards becoming debt-free.

Emotional Spending

Using Shopping as a Coping Mechanism

Emotional spending, often referred to as “retail therapy,” occurs when individuals use shopping as a way to cope with negative emotions or stress. While purchasing items may provide temporary relief, it does not address the root cause of the emotional distress and can lead to increased debt and financial instability. Finding healthier ways to manage emotions, such as exercising, practicing mindfulness, or seeking support from friends and family, can help you break free from the cycle of emotional spending.

Impulse Purchases to Boost Mood

Impulse purchases are unplanned and spur-of-the-moment buying decisions that are often driven by emotions. Making impulsive purchases as a means to boost your mood can result in regret and financial strain. To overcome this habit, it’s important to pause and reflect before making any purchase. Ask yourself if the item is truly necessary and aligns with your financial goals. Delaying gratification and implementing a “cooling-off” period can help you make more thoughtful purchasing decisions and avoid going into unnecessary debt.

Emotional Triggers in Advertising

Advertisers are experts at appealing to our emotions to influence our purchasing decisions. Understanding the emotional triggers used in advertising can help you become more aware and resilient to these tactics. By identifying the emotions being targeted and the strategies used to appeal to these emotions, you can make more rational and informed purchasing choices. This increased awareness will enable you to resist the temptation to spend impulsively and stay on top of your financial well-being.

Falling for Debt Consolidation Scams

False Promises of Lower Interest Rates

Debt consolidation offers may promise lower interest rates and a simplified repayment process, but it’s important to be cautious and skeptical of such claims. Scammers and predatory lenders often prey on individuals in financial distress, offering false promises to exploit their vulnerability. Before considering any debt consolidation option, thoroughly research the company, read reviews, and consult with trusted financial advisors. Taking these extra precautions will help you avoid falling victim to debt consolidation scams and protect your financial well-being.

Hidden Fees and Additional Charges

Debt consolidation scams often involve hidden fees and additional charges that are not disclosed upfront. These fees can significantly increase the overall cost of consolidating your debts and may lead to additional financial strain. Always read the fine print, ask for clarification, and consider seeking advice from a reputable credit counseling organization. By understanding the potential costs involved, you can make informed decisions and steer clear of debt consolidation scams.

Identity Theft Risks

When considering debt consolidation or any financial service, it’s crucial to protect yourself against the risk of identity theft. Scammers may try to gather personal information under the guise of helping with debt consolidation, putting your financial security at risk. Be wary of sharing sensitive information, such as social security numbers or bank account details, unless you are confident in the legitimacy of the organization. Taking preventive measures, such as monitoring your credit reports and using secure online platforms, can help safeguard your identity and prevent falling for debt consolidation scams.

Lack of Emergency Fund

Unforeseen Expenses

Life is full of surprises, and unforeseen expenses can arise when you least expect them. Without an emergency fund to rely on, you may find yourself resorting to credit cards, loans, or falling into debt to cover these unexpected costs. Building an emergency fund is essential to protect yourself from financial setbacks, such as medical emergencies, car repairs, or unexpected home repairs. By setting aside a portion of your income regularly, you can create a safety net that provides peace of mind and reduces the need for additional borrowing.

Emergency Medical Bills

Medical emergencies can come with hefty bills that can quickly overwhelm your finances. Without an emergency fund or proper insurance coverage, you may have to resort to high-interest loans or credit cards to cover these expenses. To avoid this situation, it’s crucial to have health insurance coverage in place and allocate funds towards building an emergency fund specifically for medical emergencies. Planning ahead and being prepared for unexpected medical expenses can help alleviate the financial burden and protect your financial well-being.

Home or Car Repairs

Home and car repairs are inevitable expenses that can significantly impact your finances if you’re not prepared. Ignoring necessary repairs can lead to more extensive damage and even higher costs down the line. It’s essential to allocate funds for home or car maintenance and repairs in your budget and continually contribute to your emergency fund. By planning ahead and being proactive, you can avoid the stress and financial strain associated with major home or car repairs.

In conclusion, adopting healthy financial habits is crucial for maintaining a stable and debt-free lifestyle. By avoiding overspending, relying too heavily on credit cards, recognizing warning signs, educating yourself about personal finance, living within your means, prioritizing debt repayment, avoiding emotional spending and scams, and building an emergency fund, you can establish a solid foundation for long-term financial success. Remember, small changes in your financial habits today can lead to significant positive impacts on your financial well-being in the future.

© 2015-2023 by burdenofdebt.com, a LIVenture. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of LiVentures LLC.