Debt Consolidation: Is It The Right Strategy For You?

If you find yourself drowning in debt and searching for a way to regain control of your finances, debt consolidation might just be the solution you’ve been looking for. With the potential to simplify your payments, reduce interest rates, and lower your overall debt burden, it’s no wonder this strategy has gained popularity among those seeking financial freedom. But, before you jump in headfirst, it’s important to understand what debt consolidation entails and whether it is truly the right strategy for you. In this article, we will explore the concept of debt consolidation and provide you with the information you need to make an informed decision about your financial future.

What is Debt Consolidation?

Definition

Debt Consolidation is a financial strategy that allows individuals to combine multiple debts into a single loan with one monthly payment. It is a method that aims to simplify debt repayment by streamlining multiple debts into a more manageable and structured plan. This can help individuals take control of their finances and potentially lower their interest rates, resulting in reduced monthly payments. Debt consolidation can be an effective tool for those struggling with multiple debts and seeking a way to regain control of their financial situation.

How does it work?

Debt consolidation works by taking out a new loan or credit line to pay off all existing debts. This new loan eliminates the need to make separate payments to multiple creditors and simplifies the debt repayment process. By consolidating debts, individuals can potentially secure a lower interest rate than what they were previously paying. This can lead to significant savings in terms of overall interest payments over time.

Types of debt consolidation

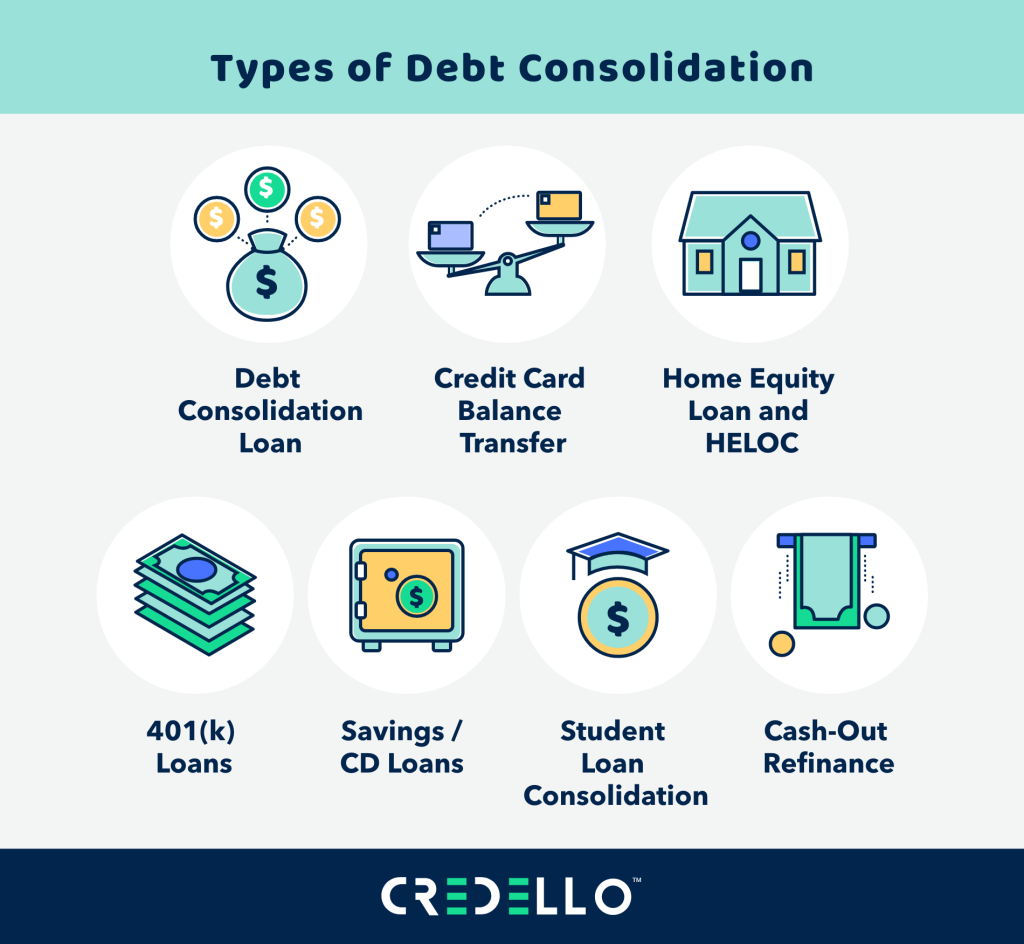

There are various methods of debt consolidation, each catering to different financial situations and needs. Some commonly used types of debt consolidation include:

- Debt consolidation loans: These loans are specifically designed for consolidating multiple debts into a single loan. They can be obtained from traditional financial institutions or online lenders and are used to pay off existing debt.

- Home equity loans or lines of credit: Homeowners may opt to consolidate their debts using the equity in their homes. This option allows individuals to borrow against the value of their home and use the funds to pay off their debts.

- Balance transfer credit cards: This method involves transferring the balances of high-interest credit cards onto a new card with a lower interest rate or an introductory 0% APR period. By consolidating credit card debt in this way, individuals can potentially save on interest payments.

- Personal loans: Personal loans can also be used for debt consolidation purposes and are an option for those who do not have any collateral or do not wish to use their home equity.

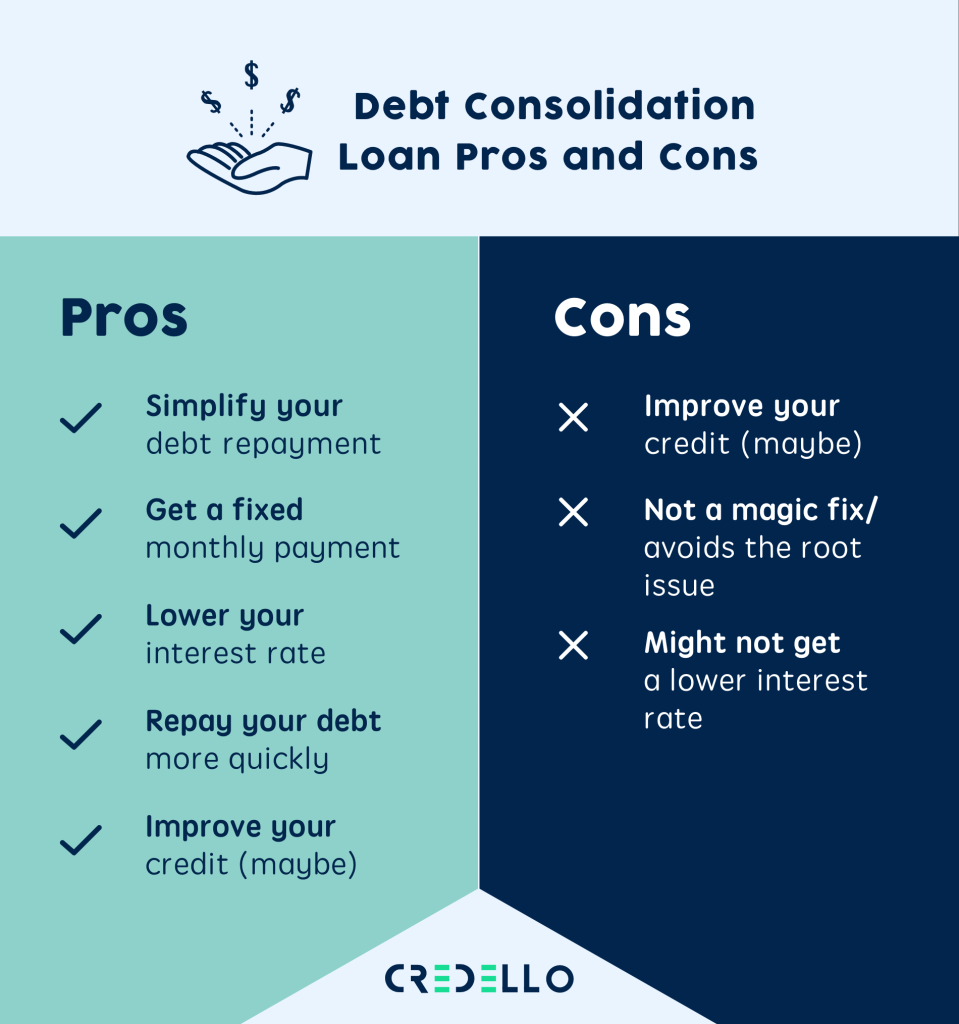

Pros of Debt Consolidation

Simplifies debt repayment

One of the most significant advantages of debt consolidation is the simplification of debt repayment. Instead of juggling multiple due dates and payments, you only have to focus on making a single monthly payment. This can make it easier to keep track of your finances and ensure that you do not miss any payments.

Lower interest rates

Debt consolidation often comes with the benefit of lower interest rates. By consolidating your debts, you may be able to secure a loan or credit line with a lower interest rate than what you were previously paying on each individual debt. This can result in significant savings over time, especially if you were dealing with high-interest debts.

Reduced monthly payments

Consolidating your debts can also lead to reduced monthly payments. With a lower interest rate and a structured repayment plan, individuals may find themselves with a more affordable monthly payment. This can free up cash flow, allowing for better financial management and potentially providing the opportunity to save or invest in other areas.

Improves credit score

Another advantage of debt consolidation is the potential to improve your credit score. By consolidating your debts and making timely payments, you can demonstrate responsible financial behavior to credit bureaus. This can positively impact your credit score over time, making it easier to qualify for better loan terms and interest rates in the future.

Cons of Debt Consolidation

Risk of accruing more debt

One of the risks associated with debt consolidation is the temptation to accrue more debt. After consolidating your debts, it is crucial to address the underlying factors that led to the accumulation of debt in the first place. Without adopting responsible financial habits, individuals may find themselves back in a similar situation, with even more debt to manage.

May have a longer repayment term

While debt consolidation can help simplify debt repayment, it may also result in a longer overall repayment term. By extending the repayment period, individuals may end up paying more in interest over the life of the loan. It is important to carefully consider the implications of a longer repayment term and weigh it against the potential benefits of lower monthly payments.

Potential for higher overall interest payments

Although debt consolidation can lead to lower interest rates, it is not always guaranteed. Depending on the terms of the new loan or credit line, individuals may end up paying more in interest over time. It is essential to carefully review and compare interest rates, fees, and terms before deciding on a debt consolidation option.

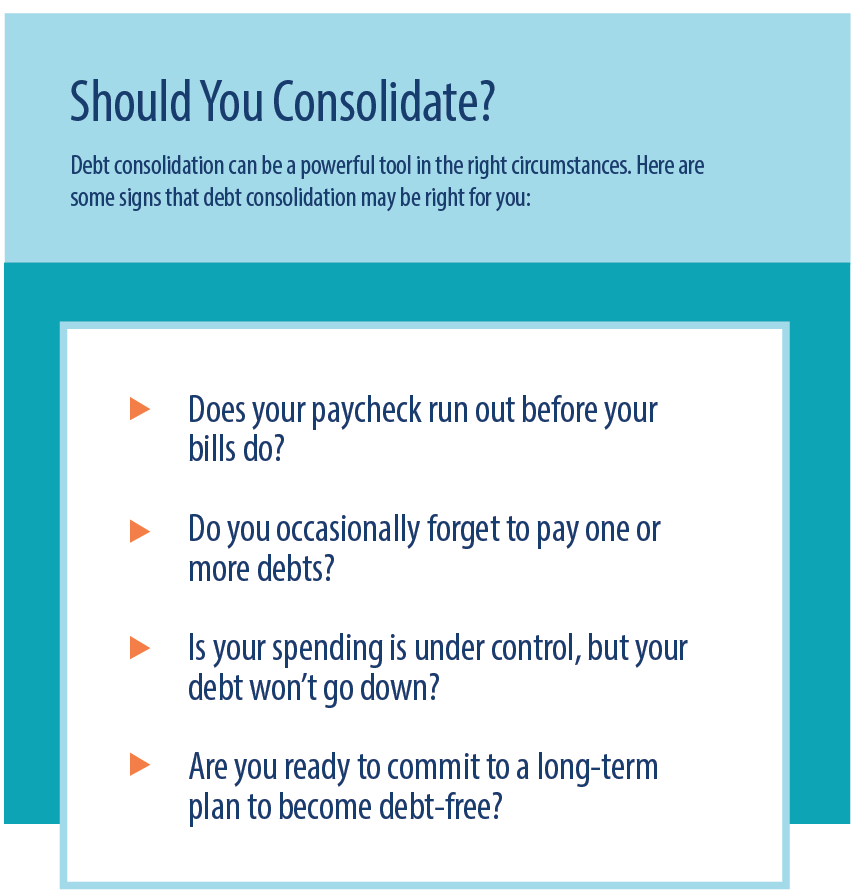

Determining if Debt Consolidation is Right for You

Evaluate your financial situation

Before considering debt consolidation, it is crucial to evaluate your financial situation. Take stock of your debts, income, and expenses to get a clear picture of your financial health. Consider whether your current debts are manageable or if they are causing significant financial strain.

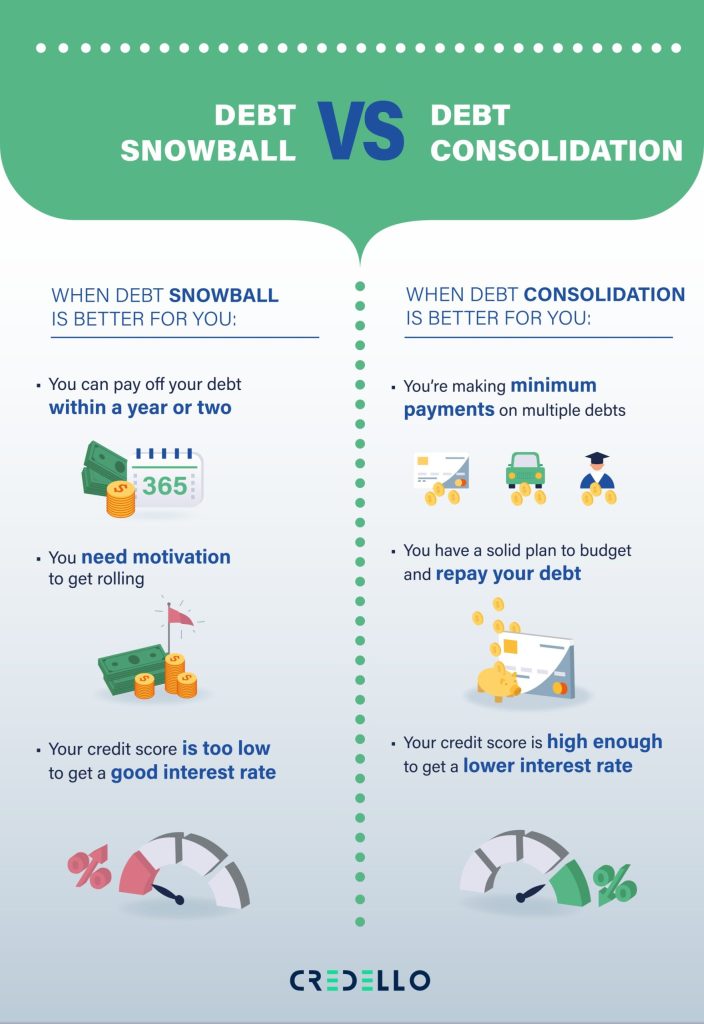

Assess your credit score

Your credit score plays a crucial role in determining your eligibility for favorable loan terms and interest rates. It is important to assess your credit score and understand how it may impact your ability to qualify for a debt consolidation loan or credit line. If your credit score is low, you may need to explore alternative debt relief options.

Consider other debt-relief options

Debt consolidation is not the only option available for those struggling with debt. Consider other debt-relief options such as debt management programs, debt settlement, or even bankruptcy. Each option has its own advantages and disadvantages, so it is important to explore all possible avenues before making a decision.

Seek professional advice

If you are unsure whether debt consolidation is the right strategy for you, it is advisable to seek professional advice. A financial advisor or credit counselor can provide insights tailored to your specific financial situation. They can help you understand the potential risks and benefits of debt consolidation and guide you toward the best course of action.

Factors to Consider Before Opting for Debt Consolidation

Total debt amount

Before opting for debt consolidation, consider the total amount of debt you have. Debt consolidation may be more suitable for individuals with a moderate amount of debt rather than those with excessive debt burdens.

Interest rates

Take a close look at the interest rates you are currently paying on your debts. If the interest rates are high and you can potentially secure a lower interest rate through debt consolidation, it may be a viable option for you.

Repayment period

Consider your financial goals and the timeline you have in mind for paying off your debts. The repayment period associated with debt consolidation can vary. It is important to choose a repayment term that aligns with your financial goals and preferences.

Collateral

Some debt consolidation options require collateral, such as home equity. If you are not comfortable using collateral or do not have any, consider alternative consolidation methods that do not require collateral, such as personal loans or balance transfer credit cards.

Different Debt Consolidation Strategies

Debt consolidation loans

Debt consolidation loans involve taking out a new loan to pay off your existing debts. This loan is specifically designed for debt consolidation purposes, and the proceeds are used to repay your outstanding debts. You then make a single monthly payment towards the consolidation loan.

Home equity loans or lines of credit

Homeowners have the option to use the equity in their homes to secure a loan or line of credit for debt consolidation. This method allows individuals to borrow against the value of their homes and use the funds to pay off their debts. It is important to note that using home equity as collateral puts your home at risk if you are unable to make the loan payments.

Balance transfer credit cards

Balance transfer credit cards offer an introductory 0% APR period or a lower interest rate for a specified timeframe. Individuals can transfer their existing credit card balances onto the new card, consolidating their credit card debt into a single payment. It is important to carefully review the terms and conditions, including any balance transfer fees, to ensure that this option is cost-effective.

Personal loans

Personal loans can be used for various purposes, including debt consolidation. These loans are typically unsecured, meaning they do not require collateral. The funds obtained from a personal loan can be used to pay off multiple debts, leaving the borrower with a single loan payment to manage.

Debt Consolidation Companies: Advantages and Disadvantages

Benefits of using a debt consolidation company

Using a debt consolidation company can have several advantages. These companies specialize in debt consolidation and have expertise in negotiating with creditors on your behalf. They can help you secure favorable interest rates and repayment terms, potentially saving you money in the long run. Additionally, debt consolidation companies can provide guidance and support throughout the debt consolidation process, making it less daunting for individuals.

Potential drawbacks of using a debt consolidation company

While there are advantages to working with a debt consolidation company, it is important to be aware of the potential drawbacks. Some companies may charge high fees for their services, which can eat into the potential savings of debt consolidation. Additionally, not all debt consolidation companies may have your best interests at heart, so it is important to research and choose a reputable company.

Steps to Successfully Consolidate Your Debt

Assess your debts and create a comprehensive list

Start by assessing your debts and creating a comprehensive list that includes the type of debt, the outstanding balance, interest rates, and monthly payments. This will give you a clear understanding of your overall debt situation and help you determine the best way to consolidate your debts.

Research and compare debt consolidation options

Once you have a comprehensive list of your debts, research and compare different debt consolidation options. Consider the pros and cons of each method, including interest rates, fees, repayment terms, and eligibility criteria. Choose the option that aligns best with your financial goals and preferences.

Apply for the chosen debt consolidation method

Once you have identified the debt consolidation method that suits your needs, gather all the necessary documents and apply for the loan or credit line. Be prepared to provide proof of income, identification, and any other required documentation. Ensure that you fully understand the terms and conditions before signing any agreements.

Follow through with the consolidation plan

After obtaining the debt consolidation loan or credit line, it is essential to follow through with the consolidation plan. Make your payments on time and in full, as agreed upon. This will not only help you pay off your debts but also contribute to improving your overall financial health.

Alternatives to Debt Consolidation

Debt management programs

Debt management programs involve working with a credit counseling agency to create a structured repayment plan for your debts. These programs often involve negotiating with creditors to lower interest rates and reduce monthly payments. This can be a suitable alternative for individuals who do not qualify for debt consolidation or prefer a more structured approach to debt repayment.

Debt settlement

Debt settlement involves negotiating with creditors to settle your debts for a reduced amount. This can provide a more immediate solution for individuals who are unable to keep up with their debt payments. However, it is important to note that debt settlement can have negative consequences on your credit score and should only be considered as a last resort.

Bankruptcy

Bankruptcy should be considered as an absolute last resort. It is a legal process that allows individuals or businesses to eliminate or restructure their debts. While bankruptcy can provide a fresh start for those in severe financial distress, it has long-term consequences on creditworthiness and should only be considered after careful deliberation and professional advice.

Conclusion

Debt consolidation can be an effective strategy for individuals seeking a more manageable and structured approach to debt repayment. It simplifies the process by combining multiple debts into a single loan or credit line, potentially resulting in lower interest rates and reduced monthly payments. However, it is important to carefully consider the advantages and disadvantages of debt consolidation, as well as other available debt relief options, before making a decision. Assess your financial situation, and credit score, and explore different consolidation methods to determine the best strategy for you. Seek professional advice if needed to ensure that you make an informed decision that aligns with your financial goals and circumstances.

© 2015-2023 by burdenofdebt.com, a LIVenture. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of LiVentures LLC.