How Debt Can Ruin Your Life

Introduction

In today’s society, debt has become a common aspect of many people’s lives. From student loans and mortgages to credit card debt, it’s easy to accumulate debt without even realizing the long-term consequences. However, debt can have a significant impact on individuals, society, and the economy as a whole. In this article, we will explore the ways in which debt can ruin your life and discuss the implications it has on society and the economy.

The Cycle of Debt

One of the main reasons why debt can ruin your life is the cycle it creates. Many individuals find themselves trapped in a never-ending cycle of borrowing money to pay off existing debt, leading to a constant struggle to stay afloat. This can result in high levels of stress and anxiety, as well as a deterioration in mental health.

Financial Instability

Debt can also lead to financial instability. When a significant portion of your income is dedicated to paying off debt, it becomes challenging to save money for emergencies or future goals. This lack of financial stability can prevent individuals from taking advantage of opportunities or pursuing their dreams, ultimately hindering personal growth and development.

Impact on Relationships

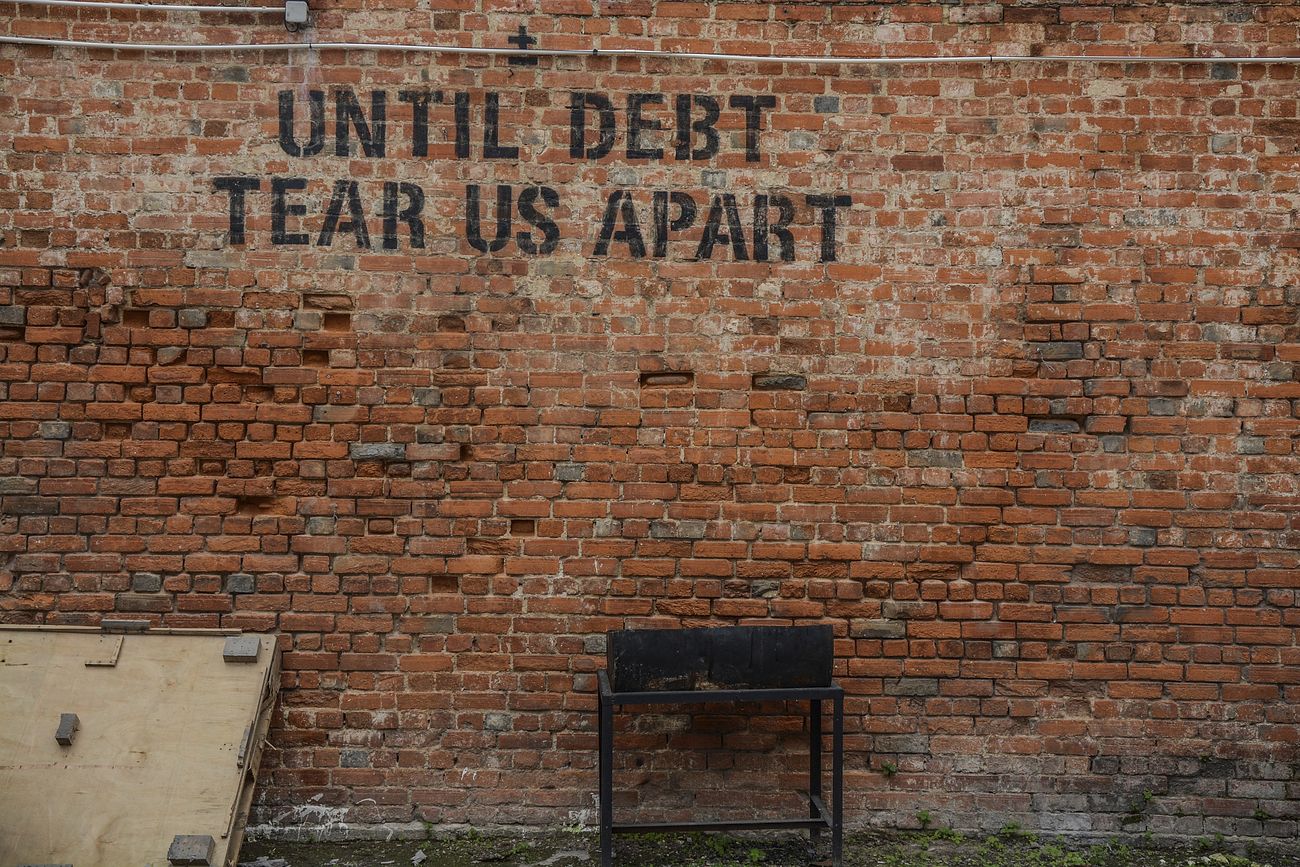

Debt can also have a detrimental effect on relationships. Financial stress is a leading cause of arguments and disagreements among couples and families. The constant pressure of debt can strain relationships, leading to increased tension and, in some cases, even separation or divorce. Moreover, the burden of debt can also affect relationships with friends and family, as individuals may feel embarrassed or ashamed about their financial situation.

Health Consequences

The impact of debt extends beyond financial and emotional stress. Studies have shown that individuals burdened with debt are more likely to experience health problems such as depression, anxiety, and other mental health disorders. The constant worry about debt can affect sleep patterns, lead to unhealthy coping mechanisms such as substance abuse, and ultimately have a negative impact on overall well-being.

Implications for Society

The effects of debt are not limited to individuals alone; they also have implications for society as a whole. When a significant portion of the population is in debt, it can lead to decreased consumer spending, which, in turn, affects the economy. Additionally, the strain on social welfare systems increases as individuals unable to manage their debt may require support from government programs. This puts an additional burden on taxpayers and limits the resources available for other social initiatives.

Impact on the Economy

Debt has the potential to significantly impact both individuals and society as a whole. When discussing the implications of debt on society and the economy, it is important to consider the various aspects and effects it can have.

First and foremost, debt can have detrimental effects on individuals’ lives. Excessive debt can lead to financial strain, stress, and anxiety. It can restrict individuals from achieving their goals and aspirations, such as purchasing a home, starting a business, or pursuing higher education. Moreover, the burden of debt can have a negative impact on mental health, relationships, and overall well-being. High levels of debt can also lead to a cycle of borrowing and repayment, making it difficult for individuals to break free from the burden.

In addition to its personal implications, debt can have a significant impact on society. As individuals struggle with debt, their ability to contribute to the economy is diminished. They may have to cut back on spending, leading to decreased consumer demand and potentially affecting businesses. This, in turn, could result in layoffs, reduced economic growth, and even a recession. Furthermore, the increased number of defaults on loans and bankruptcies can strain financial institutions, leading to instability within the banking system.

The implications of debt on the economy are far-reaching. Excessive debt levels can hinder investment and economic development. When individuals are burdened with debt, they may be less likely to invest in long-term assets or contribute to savings and investment programs. This can impede economic growth and limit the creation of new jobs. Additionally, high levels of public debt can lead to increased government borrowing, putting a strain on public finances and potentially leading to reduced public services and increased taxes.

Societal and economic implications of debt go beyond the individual level. The cycle of debt can perpetuate income inequality and social stratification. Those with limited financial resources may find themselves trapped in a cycle of debt, unable to escape its clutches. This can further exacerbate socioeconomic disparities, as individuals with higher incomes have more opportunities to avoid excessive debt.

Efforts to address the implications of debt on society and the economy should focus on promoting financial literacy and responsible borrowing. Educating individuals about managing debt, budgeting, and saving can help prevent excessive debt and its associated consequences. Implementing regulations and consumer protection measures can also mitigate the risks associated with predatory lending practices.

In conclusion, debt can have significant implications for both individuals and society. It can hinder personal well-being, restrict economic growth, and perpetuate social inequalities.

Editor note: Article updated June 29, 2023.

© 2015-2023 by burdenofdebt.com, a LIVenture. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of LiVentures LLC.