The Role Of Credit Counseling In Managing Your Debt

Are you struggling with debt and unsure of how to effectively manage it? Look no further than credit counseling. In this article, we will explore the crucial role that credit counseling plays in helping individuals navigate their financial troubles. With the guidance and expertise of credit counselors, you can gain a deeper understanding of your debt, develop personalized strategies to manage it, and ultimately regain control of your financial well-being. Say goodbye to sleepless nights and constant worry – credit counseling is here to support you on your journey to financial stability.

Overview of Credit Counseling

Definition of credit counseling

Credit counseling is a service provided by organizations that aim to help individuals manage their debt and improve their financial situation. It involves working closely with certified credit counselors who provide guidance, education, and support to individuals facing financial challenges.

Benefits of credit counseling

Credit counseling offers several benefits to individuals struggling with debt. One of the key advantages is the opportunity to gain a better understanding of personal finances and develop effective strategies to regain control. By working with credit counselors, individuals can learn how to manage their debt, create realistic budgets, and develop long-term financial goals. Credit counseling can also help negotiate with creditors to lower interest rates or create more manageable payment plans. Ultimately, the goal of credit counseling is to help individuals become financially stable and achieve a debt-free future.

When to Seek Credit Counseling

Recognizing signs of financial distress

Recognizing the signs of financial distress is crucial in determining when to seek credit counseling. It is important to be aware of warning signs such as struggling to make minimum payments, receiving frequent calls from creditors or collection agencies, consistently exceeding credit card limits, and living paycheck to paycheck with no savings. These signs indicate a need for assistance in managing debt and financial obligations.

Determining if credit counseling is right for you

While credit counseling can benefit many individuals, it is essential to assess whether it is the right option for your specific financial situation. Consider your level of debt, ability to manage monthly payments, and willingness to commit to developing and following a financial plan. Credit counseling can provide valuable insights and support, but it requires active participation and dedication to make lasting changes.

Finding a Credit Counseling Agency

Researching reputable credit counseling agencies

When searching for a credit counseling agency, it is crucial to research reputable organizations. Look for agencies that are non-profit and accredited by recognized associations, such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Reputable agencies are transparent about their services and fees, and they strive to educate and empower individuals rather than profit from their financial difficulties.

Checking credentials and certifications

To ensure the credibility of a credit counseling agency, it is important to check their credentials and certifications. Look for agencies with certified counselors who have received proper training and accreditation from recognized organizations. These certifications demonstrate the expertise and knowledge required to provide effective credit counseling services.

Reading client reviews and testimonials

Reading client reviews and testimonials can provide valuable insights into the experiences and outcomes of working with a particular credit counseling agency. Look for feedback and success stories from individuals who have successfully improved their financial situation through credit counseling. This can help you gauge the agency’s reputation and effectiveness in helping clients manage their debt.

The Process of Credit Counseling

Initial consultation and assessment

Credit counseling typically begins with an initial consultation and assessment conducted by a certified credit counselor. During this session, the counselor will review your financial situation, including income, expenses, debts, and assets. This assessment helps the counselor gain a comprehensive understanding of your financial landscape and allows them to provide personalized guidance and recommendations.

Developing a customized financial plan

Based on the assessment, the credit counselor will work with you to develop a customized financial plan. The plan will include strategies to address your specific financial challenges and goals, such as creating a budget, identifying areas for expense reduction, and developing a debt repayment plan. The counselor will provide guidance on prioritizing debts, negotiating with creditors, and managing your financial obligations effectively.

Negotiating with creditors

One of the key roles of a credit counselor is to negotiate with creditors on behalf of their clients. Depending on your financial situation, the counselor may negotiate to reduce interest rates, waive fees, or establish more manageable repayment plans. These negotiations aim to alleviate the burden of debt and create a more favorable financial arrangement for you.

Debt management and repayment strategies

Credit counselors provide valuable guidance on debt management and repayment strategies. They assist in setting up debt management plans, which involve combining multiple debts into a single monthly payment. This simplifies the repayment process and may involve lower interest rates, reduced fees, and a structured timeline for debt repayment. Credit counselors can also provide advice on strategies for accelerating debt repayment and avoiding future debt.

Educating clients about budgeting and financial literacy

In addition to debt management strategies, credit counseling agencies also prioritize educating their clients about budgeting and financial literacy. Counselors provide resources and tools to help individuals create and maintain realistic budgets, track expenses, and make informed financial decisions. By improving financial literacy, credit counseling empowers individuals to manage their money effectively and avoid future financial pitfalls.

Credit Counseling vs. Debt Consolidation

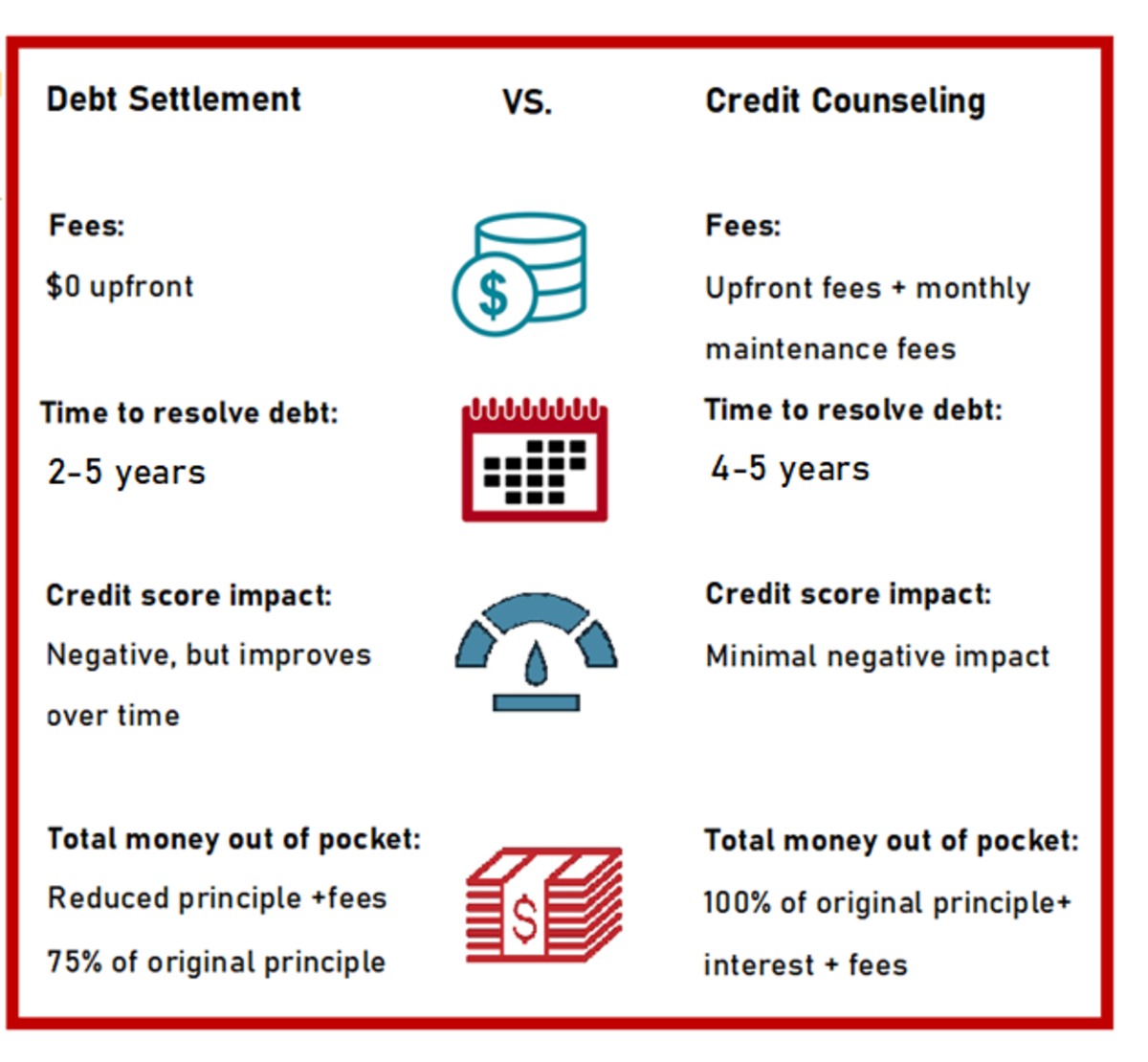

Understanding the difference

Credit counseling and debt consolidation are often confused, but they are distinct approaches to managing debt. Credit counseling focuses on education, guidance, and support to help individuals understand and manage their debts more effectively. It involves working with a certified credit counselor who provides personalized assistance throughout the process. Debt consolidation, on the other hand, involves combining multiple debts into a single loan or credit line. This can simplify the repayment process and potentially result in a lower overall interest rate.

Assessing which option is best for your situation

Choosing between credit counseling and debt consolidation depends on your individual financial situation and goals. Credit counseling is beneficial for individuals who need guidance, education, and support to develop healthy financial habits and tackle their debts effectively. It is especially useful for those who want to understand the root causes of their financial challenges and gain long-term financial stability. Debt consolidation, on the other hand, may be more suitable if you have high-interest debts and want to simplify the repayment process by consolidating them into a single loan or credit line.

Credit Counseling and Credit Scores

Impact of credit counseling on credit scores

One common concern individuals have when considering credit counseling is its impact on their credit scores. While credit counseling itself does not directly impact credit scores, enrolling in a debt management plan can have some short-term effects. When you enroll in a debt management plan, creditors may report this to credit bureaus, which may temporarily lower your credit score. However, as you make consistent payments and demonstrate responsible financial behavior, your credit score can improve over time.

Rebuilding credit after credit counseling

Credit counseling can actually provide individuals an opportunity to rebuild their credit over time. By faithfully following the customized financial plan developed with the credit counselor, individuals can establish a positive payment history and reduce their overall debt. Over time, this responsible financial behavior can lead to an improvement in credit scores and a stronger credit profile.

Fees and Costs of Credit Counseling

Understanding fee structures

Credit counseling agencies typically charge fees for their services, but most reputable agencies offer affordable options. Some agencies operate as non-profit organizations, which often have lower fees. When considering a credit counseling agency, it is important to have a clear understanding of their fee structure and the specific services included. Reputable agencies are transparent about their fees and provide detailed information about the costs associated with their services.

Looking out for hidden costs

While credit counseling agencies strive to be transparent, it is crucial to be aware of any potential hidden costs or fees. Before enrolling in a credit counseling program, carefully review and understand the terms and conditions, including any potential additional costs. Ask specific questions about fees and charges to ensure you are fully informed before making a commitment. This will help you avoid any unwelcome surprises in the future.

Legal and Regulatory Considerations

Laws and regulations governing credit counseling

Credit counseling agencies operate within a legal and regulatory framework designed to protect individuals seeking financial assistance. It is important to familiarize yourself with the laws and regulations governing credit counseling services in your country or state. Research the licensing requirements for credit counseling agencies in your jurisdiction, and ensure that the agency you choose complies with these requirements.

Avoiding scams and fraudulent practices

Unfortunately, there are scammers who prey on individuals in financial distress. To avoid falling victim to fraudulent practices, it is essential to be cautious and discerning when selecting a credit counseling agency. Look for red flags such as agencies that guarantee unrealistic outcomes, charge exorbitant upfront fees, or pressure you into making immediate decisions. Always research agencies thoroughly and consider seeking recommendations from trusted sources to ensure you choose a reputable organization.

Success Stories and Testimonials

Real-life examples of individuals benefiting from credit counseling

Real-life success stories and testimonials can provide encouragement and inspiration for individuals considering credit counseling. These stories highlight how credit counseling has helped individuals overcome financial challenges, manage their debts effectively, and achieve financial stability. Reading about others who have successfully improved their financial situation through credit counseling can provide motivation and reassurance that taking this step can lead to positive outcomes.

Conclusion

The importance of credit counseling in managing debt

Credit counseling plays a vital role in helping individuals manage their debt and achieve financial stability. It offers valuable support, education, and guidance to individuals facing financial challenges. By working with credit counselors, individuals can develop effective strategies to regain control of their finances, negotiate with creditors, and improve their financial literacy.

Final thoughts and recommendations

If you are struggling with debt or facing financial distress, credit counseling can provide the assistance and resources you need to overcome these challenges. Remember to research reputable agencies, check credentials, and read client reviews before choosing a credit counseling agency. By taking the necessary steps to address your financial situation and seeking professional guidance, you can pave the way toward a debt-free future and a healthier financial life.

© 2015-2023 by burdenofdebt.com, a LIVenture. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of LiVentures LLC.