What Is Personal Vs Public Debt?

In this article, you will gain a clear understanding of the distinction between personal and public debt. Whether you’re looking to improve your financial literacy or simply curious about the topic, this article aims to provide you with valuable insights. By exploring the concept of personal debt versus public debt, you will acquire the necessary context to comprehend the different types of debt and their implications on individuals and nations. So, let’s dive into the world of debt and unravel its complexities together.

Definition of Personal Debt

Personal debt refers to the amount of money an individual owes to creditors or financial institutions. It is the result of borrowing money from various sources to fulfill personal needs, such as purchasing a house, financing education, or covering day-to-day expenses. Unlike public debt, which is incurred by governments, personal debt is an obligation that falls solely on the individual. Personal debt can come in various forms, including mortgage loans, student loans, credit card debt, and auto loans.

Definition of Public Debt

Public debt, also known as government debt or national debt, refers to the total outstanding amount of money that a country’s government owes to creditors. It is the accumulation of deficits incurred by the government over time. Public debt is typically incurred to finance government spending, bridge budget gaps, or support investments in infrastructure, healthcare, education, and other public services. Unlike personal debt, which is incurred by individuals, public debt represents the financial obligations of an entire nation.

Personal Debt: Meaning and Examples

Personal debt is the financial liability individuals incur through borrowing money for personal purposes. It involves entering into borrowing agreements with financial institutions or creditors, resulting in an obligation to repay the borrowed funds within a given timeframe. Personal debt can be used for a variety of purposes, and some common examples include:

Mortgage Loans

Mortgage loans are a type of personal debt used to finance the purchase of a home. Individuals borrow money from a lender, typically a bank, in exchange for the right to use the property as collateral until the loan is repaid. These loans are generally long-term and involve regular monthly payments, consisting of both principal and interest.

Student Loans

Student loans are debts acquired to finance higher education expenses, including tuition, books, and living costs. These loans are usually provided by the government or private financial institutions and are repaid by the borrower after completing their education. Student loans can have varying interest rates and repayment terms, depending on the lender and the borrower’s financial circumstances.

Credit Card Debt

Credit card debt is a form of personal debt that arises from using credit cards to make purchases. When individuals use their credit cards, they are essentially borrowing money from the credit card issuer. Failure to repay the borrowed amount in full by the due date results in the accumulation of credit card debt, which often carries high-interest rates.

Auto Loans

Auto loans are personal loans that allow individuals to purchase a vehicle without having to pay the full amount upfront. Borrowers enter into an agreement with a lender, typically a bank or a car dealership, to finance their vehicle purchases. The loan is repaid over a set period, usually through monthly installments that include both the principal amount borrowed and the interest charged.

Pros and Cons of Personal Debt

While personal debt can provide individuals with opportunities to fulfill various needs and desires, it is essential to consider the pros and cons before engaging in borrowing activities. Here are some key advantages and disadvantages of personal debt:

Pros of Personal Debt

- Access to essential assets: Personal debt, such as mortgage loans and auto loans, provides individuals with the means to acquire assets like homes and vehicles that they might not be able to afford otherwise.

- Investment in education: Student loans allow individuals to invest in their education, which can enhance their long-term earning potential and career prospects.

- Convenience and flexibility: Credit cards enable individuals to make purchases conveniently and provide financial flexibility when unexpected expenses arise.

Cons of Personal Debt

- Interest payments: Borrowing money often entails paying interest, which can make personal debt more expensive in the long run.

- Financial strain: High levels of personal debt can lead to financial stress and make it challenging to maintain a healthy financial situation.

- Risk of default: Inability to repay personal debts can result in penalties, collection actions, and damage to an individual’s credit score.

- Reduced disposable income: Regular debt payments can decrease disposable income, restricting an individual’s ability to save or invest in other areas.

Public Debt: Meaning and Examples

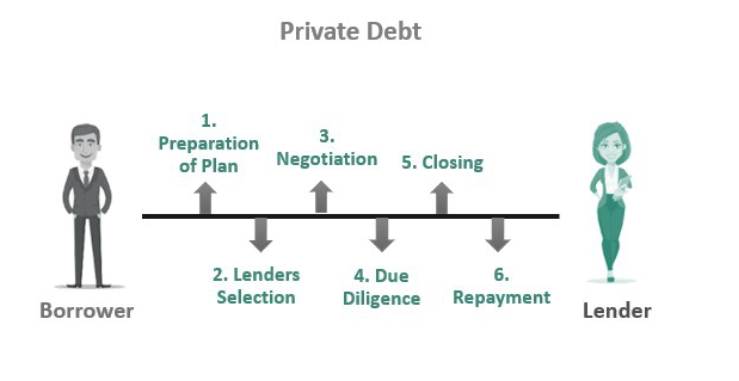

Public debt refers to the outstanding obligations incurred by a government through borrowing activities. Unlike personal debt, which falls solely on individuals, public debt represents the financial burden borne by an entire nation. Governments usually rely on public debt to finance various initiatives, carry out infrastructure projects, address budget deficits, or stimulate economic growth. Some common examples of public debt instruments include:

Government Bonds

Government bonds are issued by national governments to raise funds from investors. They represent a promise by the government to repay the borrowed amount, typically with interest, within a specified period. Government bonds are often considered safe investments, as they are backed by the full faith and credit of the issuing government.

Treasury Bills

Treasury bills, also known as T-bills, are short-term debt instruments issued by the government to finance its short-term obligations. They are typically issued with a maturity of one year or less and are considered low-risk investments. Treasury bills are sold at a discount to their face value and do not pay regular interest but rather provide a return through the difference between the purchase price and the face value.

Municipal Bonds

Municipal bonds, or munis, are debt securities issued by local governments, such as cities or states, to finance public projects or infrastructure improvements. Investors who purchase municipal bonds lend money to the government entity and are repaid with interest over time. Municipal bonds often offer tax advantages, as the interest income is generally exempt from federal income taxes.

Pros and Cons of Public Debt

Like personal debt, public debt has its advantages and disadvantages, which must be carefully considered. Here are some key pros and cons of public debt:

Pros of Public Debt

- Funding public services: Public debt allows governments to finance critical public services, such as healthcare, education, infrastructure, and defense, enhancing the overall well-being of the population.

- Economic stimulus: Governments can use public debt to implement policies aimed at stimulating economic growth during periods of recession or to fund large-scale infrastructure projects, promoting job creation and economic development.

- Investment opportunities: Public debt instruments, such as government bonds, provide individuals and institutional investors with investment opportunities characterized by stability and relative safety.

Cons of Public Debt

- Burden on future generations: Public debt may impose a financial burden on future generations, as it requires repayment with accumulated interest, potentially leading to higher taxes or reduced government spending in the future.

- Risk of default: If a government is unable to meet its debt obligations, it can lead to a sovereign debt crisis, causing severe economic consequences and loss of confidence in the country’s financial stability.

- Crowding out private investment: High levels of public debt can result in increased borrowing costs for the government, diverting resources away from private investments and potentially stifling economic growth.

Differences between Personal and Public Debt

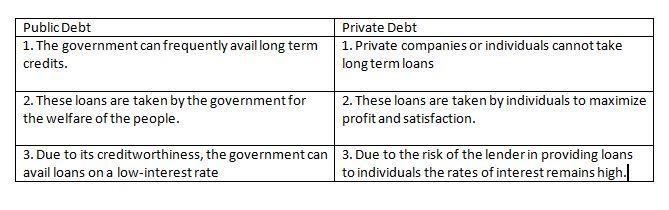

The fundamental difference between personal and public debt lies in the entities responsible for repayment. Personal debt rests solely on individuals, while public debt represents the financial obligations of a government. Personal debt is incurred by individuals for personal needs, such as housing, education, or daily expenses, while public debt is accrued by governments to finance public services and investments.

Another key distinction is the scale of debt. Personal debt is typically on a much smaller scale, limited to the borrowing capacity and financial circumstances of individuals. In contrast, public debt can be substantial and often reaches significant amounts due to the broader scope of government spending and borrowing. Public debt can impact an entire nation’s economy, whereas personal debt mainly affects individuals and their direct financial situation.

Additionally, personal and public debt differ in terms of lenders and interest rates. Individuals acquire personal debt from financial institutions or creditors such as banks, credit card companies, or lenders offering specific loans. The interest rates on personal debt are often determined by factors like creditworthiness and market conditions. On the other hand, public debt is often issued as government securities, such as bonds or bills, which are typically sold to a range of investors who expect predetermined interest payments.

Effects of Personal and Public Debt on the Economy

Both personal and public debt can have significant impacts on an economy, although the effects may differ in nature and scale.

Effects of Personal Debt on the Economy

- Consumer spending: Personal debt can stimulate consumer spending, as individuals may use borrowed funds to purchase goods and services. This increased spending can contribute to economic growth and spur business activity.

- Housing market: Mortgage loans, a significant component of personal debt, can influence the housing market. High levels of mortgage lending may lead to increased property prices, while defaults on mortgage loans can have adverse effects on both homeowners and lenders.

- Financial stability: Excessive levels of personal debt, particularly credit card debt, can lead to financial instability for individuals and negatively impact their creditworthiness. This can restrict their ability to access loans or contribute to a higher cost of borrowing, potentially affecting overall economic stability.

Effects of Public Debt on the Economy

- Fiscal policy: Public debt can have implications for a government’s fiscal policy. High levels of public debt may limit a government’s ability to pursue expansionary fiscal policies, such as increased government spending or tax cuts, as it may worsen the country’s fiscal position.

- Interest rates: Public debt can influence interest rates in an economy. Higher levels of public debt may lead to increased demand for borrowing, pushing up interest rates for both the government and private borrowers. This can affect investment decisions, business expansion, and overall economic activity.

- Creditworthiness and investor confidence: Excessive public debt or a deteriorating debt-to-GDP ratio can negatively impact a country’s creditworthiness and erode investor confidence. Reduced investor confidence can result in higher borrowing costs for the government, leading to further financial strain and potentially hampering economic growth.

In summary, while personal debt primarily affects individuals and their financial situations, public debt has broader implications for the overall economy and the fiscal health of a nation. Both types of debt can offer advantages and disadvantages, and careful management is crucial to ensure their effects on the economy remain positive and sustainable. Understanding the distinctions between personal and public debt can help individuals make informed financial decisions and foster a deeper understanding of debt’s role in the broader economic context.

© 2015-2023 by burdenofdebt.com, a LIVenture. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of LiVentures LLC.